The supreme court ruling came out about the exessive tax saving case on inheritance tax. The ruling came out on April 19th, 2022 and it was taken as a shock to those in the tax saving communities such as real estate brokerage companies, tax consultants etc. The price of the condos was approximately 1,387 MM … Read More “Suprement court ruling on the disputed apartments case came out” »

Category: Estate Tax

First, you need know to how to calculate Japanese inheritance tax and how to evaluate the taxable value for each asset categories. Cash and bank balance are the worst. They are evaluated on their face value. If he had 100 MM JPY, it is to be assessed as 100 MM as taxable estate. On the … Read More “Saving Japanese inheritance tax/estate tax” »

Gift tax is very expensive in Japan. You can see the tax rates as follows. It can even be prohibitive. Net taxable gift after base deduction Under 2M JPY Under 3M JPY Under 4M JPY Under 6M JPY Under 10M JPY Under 15M JPY Under 30M JPY Over 30M JPY Tax Rates 10% 15% 20% … Read More “Early Inheritance” »

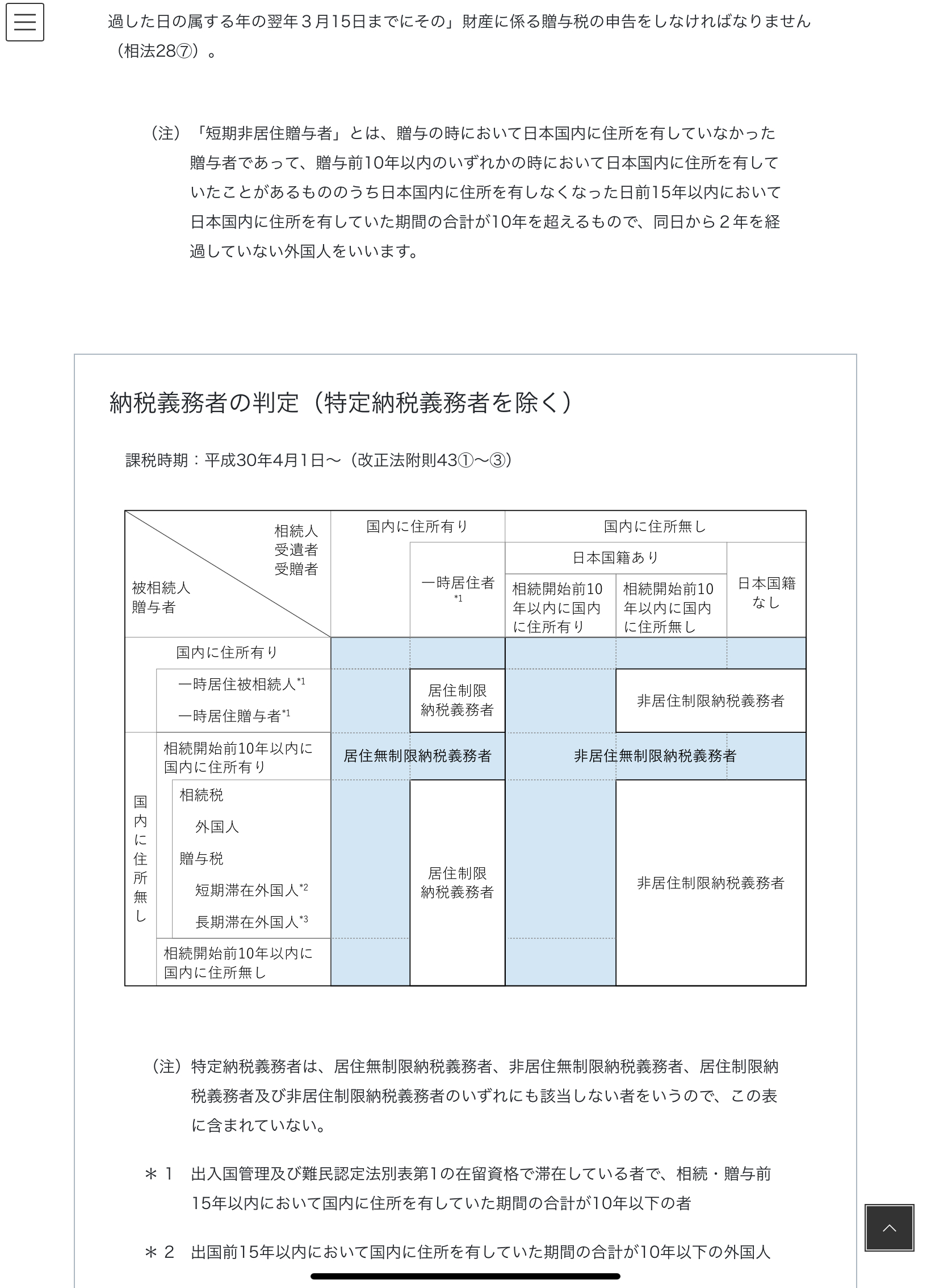

There was a revision in the Japanese Inheritance Tax in 2020. Foreigners living in Japan with workng visa are now mostly exempt of the inheritance tax. In the past, foreigners living in Japan were taxable of Japanese Inheritance Tax even if his/her heir was not living in Japan. For example, ex-pats in Japan were taxable … Read More “Japanese Inheritance Tax on foreigners” »

If no one in your family will take your business over, you may want to consider passing it to directors or employees of your company. Upside is that the person knows the business well. He has been working in the company for long. The education necessary to take over the business will be relatively mild. … Read More “Employee Buyout -EBO” »

It is easier to get understanding of others such as employees but it is not always easy to find a right person within the family. Also, if the company is a major part of your estate, because the estate law guarantees that 50% of the default split should go to other heirs, the one to … Read More “How to pass my company to my children (or another family member)” »

Many business owners should probably want to pass their businesses that they worked and built for their lives to the next generation. Successful succession of active businesses are also good for its stake holders such as those who work for the company, business partners and vendors, customers and the society. Their typical concern may be: … Read More “How to make your succession of your business successful” »

Succession/Inheritance If you own a business and you want to pass it to your children, you probably want to know how much tax you will have to pay for the transfer. It can be either a capital gain tax (if you take the form of selling), gift tax or inheritance tax. Forms of succession Some … Read More “Why you need to know your company valuation for its succession” »

I’m reading a book about Japanese “trust”. There were major changes in the laws in trust and NPO in Japan recently. There are private trust and commercial trust. Private trust is the one that was introduced by the change in law recently. Instead of a will that you make, private trust can do many many … Read More “Japanese Private Trust vs Commercial Trust. It can be convenient to set a scheme that a will cannot achieve.” »

Japanese Inheritance Tax law was amended recently to protect foreigners living in Japan on working visa (as opposed to spouse visa or Permanent Resident visa). Before the amendment of the law in March 2017, foreigners living in Japan with working visa were subject to Japanese Inheritance Tax even on foreign assets if they die in … Read More “Scope of Japanese estate tax for non-Japanese. And types of visa you should not have” »