The supreme court ruling came out about the exessive tax saving case on inheritance tax. The ruling came out on April 19th, 2022 and it was taken as a shock to those in the tax saving communities such as real estate brokerage companies, tax consultants etc. The price of the condos was approximately 1,387 MM … Read More “Suprement court ruling on the disputed apartments case came out” »

Year: 2022

In order to understand who will benefit by choosing a Consumption Tax filer status, I will explain how the consumption tax liability is calculated. The basic rule is that Consumption Tax payable is the difference between what you receive on your revenue and what you pay on your cost. I show you a very simple … Read More “Who will benefit by choosing a Consumption Tax filer status?” »

Each country has a different tax system. But Japanese Consumption Tax seems to have a little bit more confusing part than VAT or GST in other countries because it has options for SMEs (Small/Medium-sized enterprises) to file (to become a tax filer) or not to file (a non-tax filer). Also there are 2 calculation methods … Read More “How I benefit from Japanese Consumption Tax?” »

The most popular accounting software in Japan seems to be Yayoi Kaikei. Many accounting offices in Japan use this software. So do our firm. Almost all the English native speaking professionals here say they like Yayoi more than other English accounting software such as Xero, Wave or Quickbooks. The reasons may be its friendly user … Read More “Recommended Japanese accounting software” »

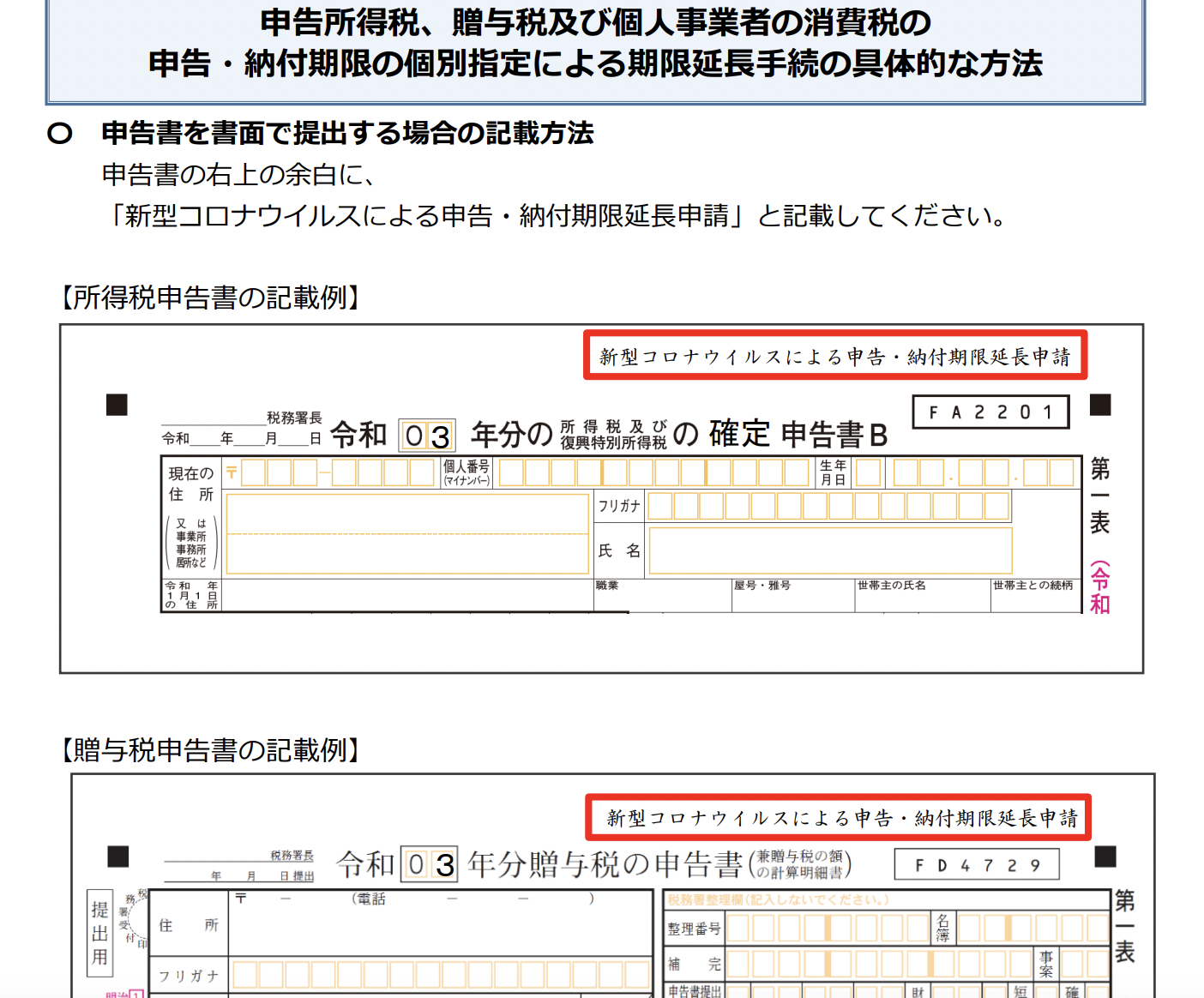

The Japanese Tax Authority announced a conditional extension of the deadline for personal tax returns which was due by March 15, 2022. Hurray! https://www.nta.go.jp/taxes/shiraberu/kansensho/faq/01.htm If you are affected by COVID or your accountant, you will be allowed automatically the extended deadline by April 15. You simply need to put “新型コロナウイルスによる申告・納付期限延長申請” (Applying an extension of the … Read More “The Japanese Tax Authority announced a conditional extension of the personal tax return deadline.” »

First, you need know to how to calculate Japanese inheritance tax and how to evaluate the taxable value for each asset categories. Cash and bank balance are the worst. They are evaluated on their face value. If he had 100 MM JPY, it is to be assessed as 100 MM as taxable estate. On the … Read More “Saving Japanese inheritance tax/estate tax” »

If your business is to buy goods in Japan and export overseas, you should be entitled to claim consumption tax refund. But don’t relax until you get back your first refund. There are several conditions to be met. 1) Choose to be a Consumption Tax filer: If you are a sole proprietor, you have to … Read More “Japanese Consumption Tax refund on your export sales. Check your export permissions first.” »