Each country has a different tax system. But Japanese Consumption Tax seems to have a little bit more confusing part than VAT or GST in other countries because it has options for SMEs (Small/Medium-sized enterprises) to file (to become a tax filer) or not to file (a non-tax filer). Also there are 2 calculation methods which can be very different in result. Each has conditions to meet to apply.

In this blog, I would like to explain who will have to pay the Japanese Consumption Tax and who will not by default and when you want to switch from the default. In some situations, companies are not consumption tax filers by default but will benefit by choosing to become a Consumption Tax filer! Businesses in certain industries (such as export or service providers to overseas clients) will definitely enjoy the benefit because they will probably get a refund.

In order to choose to become a Consumption Tax filer or not to, you need to know when you are a tax filer and when you are not by law. Since the conditions are quite confusing and the amount at stake can easily be very expensive, it’s really worth knowing.

1. Who has to file for (and pay) Japanese Consumption Tax? Who can choose to file or not to file?

Exempt status and Non-Exempt Status. The Default tax status for SMEs are Exempt.

Whether a business (either a company or a sole proprietor) is a tax filer or not depends whether its sales in 2 years ago was bigger than 10 MM (million) yen or not. The year which is 2 years ago is called Base Year by law. For example, let’s say your current fiscal year is from Jan. 1st to Dec. 31st, 2022. Whether your business is a tax filer or not depends on whether your sales was more than 10MM in 2020. If you are sales was less than 10 MM in 2020, you are not a tax filer for 2022 by default.

But you don’t have Base Year if your business has just been set up or less than 2 years old. What happens then? In a situation like this, it depends on whether your paid-in capital is more than 10MM yen or not. So, if your capital is more than 10MM yen, your company is a Consumption Tax filer for the 1st and 2nd year by default. For the 3rd year, it will depends on your sales on the 1st year, and the 4th year depends on the 2nd year sales and so on. Companies with its paid-in capital under 10MM yen and Sole-proprietors are tax exempt for the 1st and 2nd year by default.

Even if your capital is under 10MM yen or if you are a sole proprietor, you can choose to be a Consumption tax filer. The opposite direction is not allowed (Companies with paid-in capital more than 10MM yen is not allowed to choose a non-filer status).

2. Who will benefit by choosing a Consumption Tax filer status

I will explain more in detail and specific when you will benefit by choosing to become a Consumption Tax filer in the below link. Many of our clients chose to become a C. Tax filer from the first year and enjoy the benefit. Typically, their business are exporting of goods to overseas or providing services to their clients overseas.

Who will benefit by becoming a CTax filer?

3. How you can save some Consumption Tax?

While you are a C. Tax filer, there may be a room to save some Consumption Tax by adapting the right calculation method for you. There are 2 calculation methods as mentioned below:

a) Standard Method,

b) Simplified Method,

I will explain more in detail how the tax liability is calculated based on each method.

a.) Standard Method

Standard method should be the same in the other countries. You will have to pay the net of what you receive on your sales and what you pay on your cost and expenses. Please not that salaries and social insurances are not taxable expenses. That means you will have to pay about 10% of salaries and social insurance cost as consumption tax to the government if you end up being break-even at the end of your fiscal year. You may find it quite expensive. Go to the below link to see more details about Standard Method.

How to calculate consumption tax by Standard Method.

Standard method will be your choice if you are in an export business.

b.) Simplified Method.

This is only allowed to businesses whose sales in Base Year is under 50MM yen. It may reduce the tax significantly if your business model havs a simple characteristic nature where the major part of your cost is salary. I will explain below link more specifically how the tax is calculated in this calculation method and who will benefit most.

How to calculate Consumption Tax by Simplified Method.

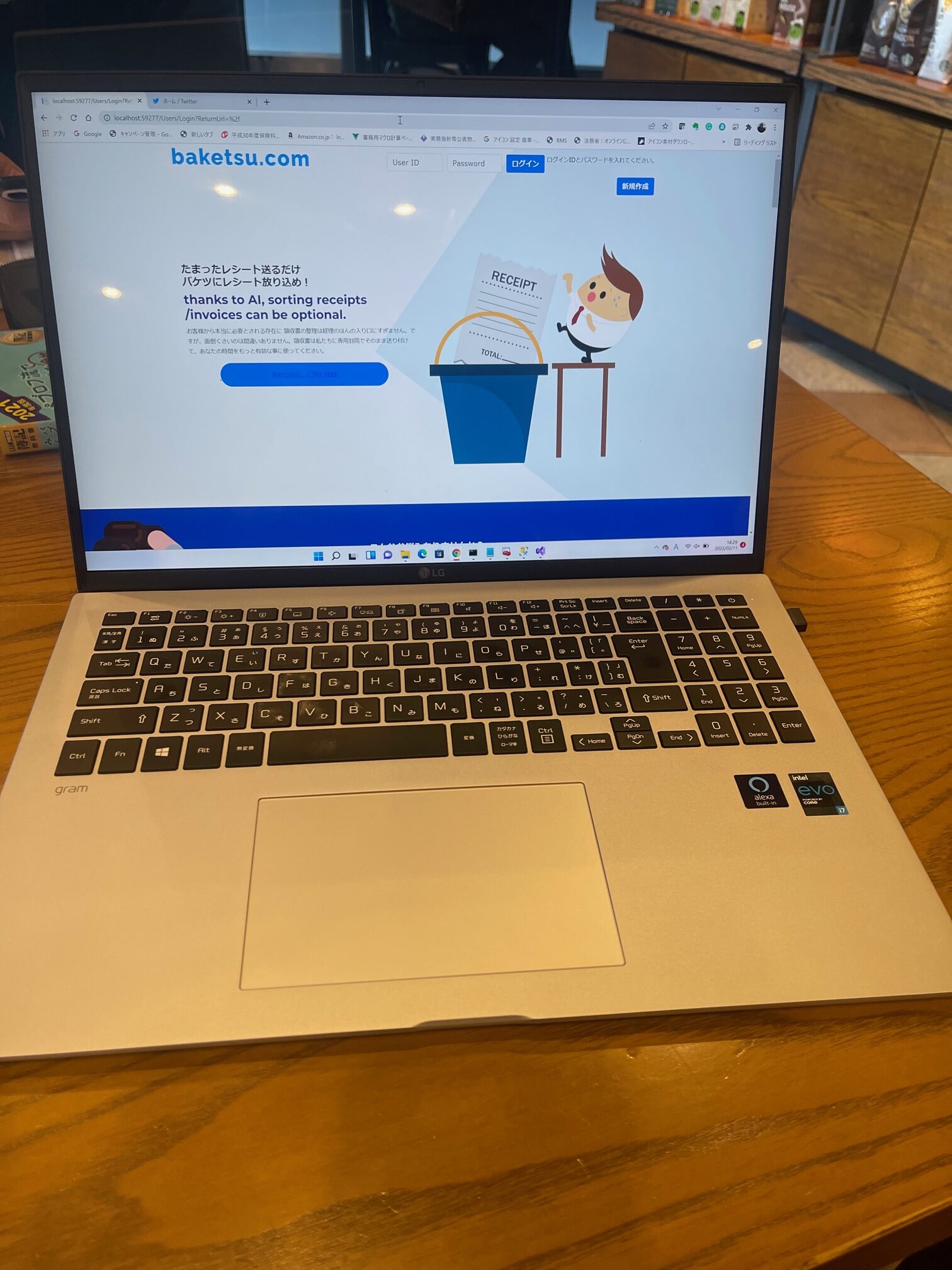

This is a page of a software that I’m working hard to develop and launch.