Loss that a company with “Blue Tax Form” status can be carried over 9 years (it will be 10 years from a fiscal year that starts after April 1, 2018). The loss can be used only when all the tax returns have been submitted since then. Loss that was incurred for fiscal year when a … Read More “Restriction in using carried loss from past -2” »

Category: Corporate Tax

You may think it would be a good idea to buy a company with tax losses accumulated from the past. You buy one and offset against taxable income in your own company. It will not work. Carried loss and unrealized loss in assets can only be utilized when its merger is regarded as qualified one. … Read More “Carried Loss – Qualified merger and acquisition” »

There are two types of NPO that you can practically set up. One is Standard Corporate Organization (SCO or 一般社団法人) and another is Standard Fund Organization (SFO or 一般財団法人). Others are so difficult that it is practically unrealistic. SCO is much easier to set up than SFO because the number of people needed to be … Read More “How to set up an NPO in Japan” »

I recently had a meeting with one of our clients. The client company is doing very well and, naturally, they wanted to talk about how to minimize their tax as their year-end is getting nearer. We knew that tax saving would be a major subject in the meeting but partly because I was occupied with … Read More “Tax saving – basics things better than sexy ones” »

It is not difficult to open up a branch or a company here in Japan now a days. To open a branch You need to appoint a Japan resident as the representative person of the branch. This person has to be a resident of Japan but his or her nationality does not matter. This person … Read More “Opening up a branch or starting a company in Japan” »

Withholding tax of 20.42% Salaries paid to non-residents are subject to Japanese withholding tax, always. If you are an employer in Japan and if you are paying salaries to non-residents, you have to take 20.42% income tax and pay to the government next month. The penalty of missing the deadline is expensive, which is 5%-10% … Read More “Tax on salary income for non-residents” »

We all know that director salary cannot be changed during a fiscal year under Japanese Corporate Tax Law except for a few exceptional situations. One typical reason is when our business becomes sour, losing money and falls in red. The rule may sound strange to foreigners or people new to Japanese business environment but that’s … Read More “When can we cut director salary? Is his poor performance enough good reason?” »

You might have heard of the term, Tokumei Kumiai (TK) before if you are in investing industry for some time already. What is it? Is it a good investment vehicle to create one for me? Overview TK is not a kind of standard partnership that you would imagine where people have equal voting right based … Read More “Tokumei Kumiai (TK) what is the point?” »

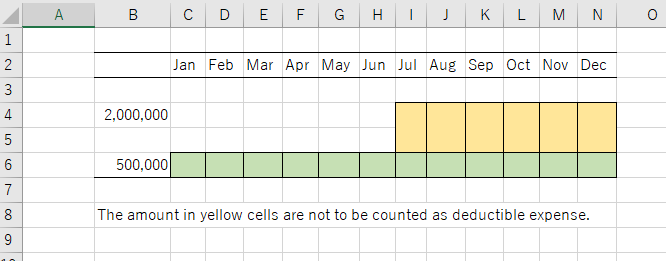

The tax law about director salary is simple, although it may look otherwise. The law says that only fixed amount of director salary is deductible from taxable corporate income. It does not mean that you cannot change/raise your salary during a fiscal year but it only means that the raised salary will not count as … Read More “Director salary cannot be raised in the middle of a fiscal year (Corporate Tax Law)” »

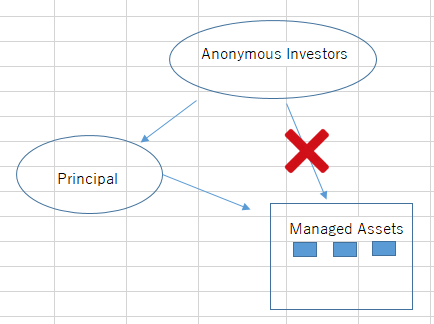

Tokumei Kumiai (or TK for short) is a popular structure as an investment vehicle among foreign investors. The direct translation of TK is “anonymous partnership”. It consists of Principal and investor-partner(s). All the assets and the liabilities directly belong to Principal. Investor-partners do hold any rights to its business assets nor take responsibility to its … Read More “Tokumei Kumiak – TK” »