The Japanese Tax Authority announced a conditional extension of the deadline for personal tax returns which was due by March 15, 2022. Hurray!

https://www.nta.go.jp/taxes/shiraberu/kansensho/faq/01.htm

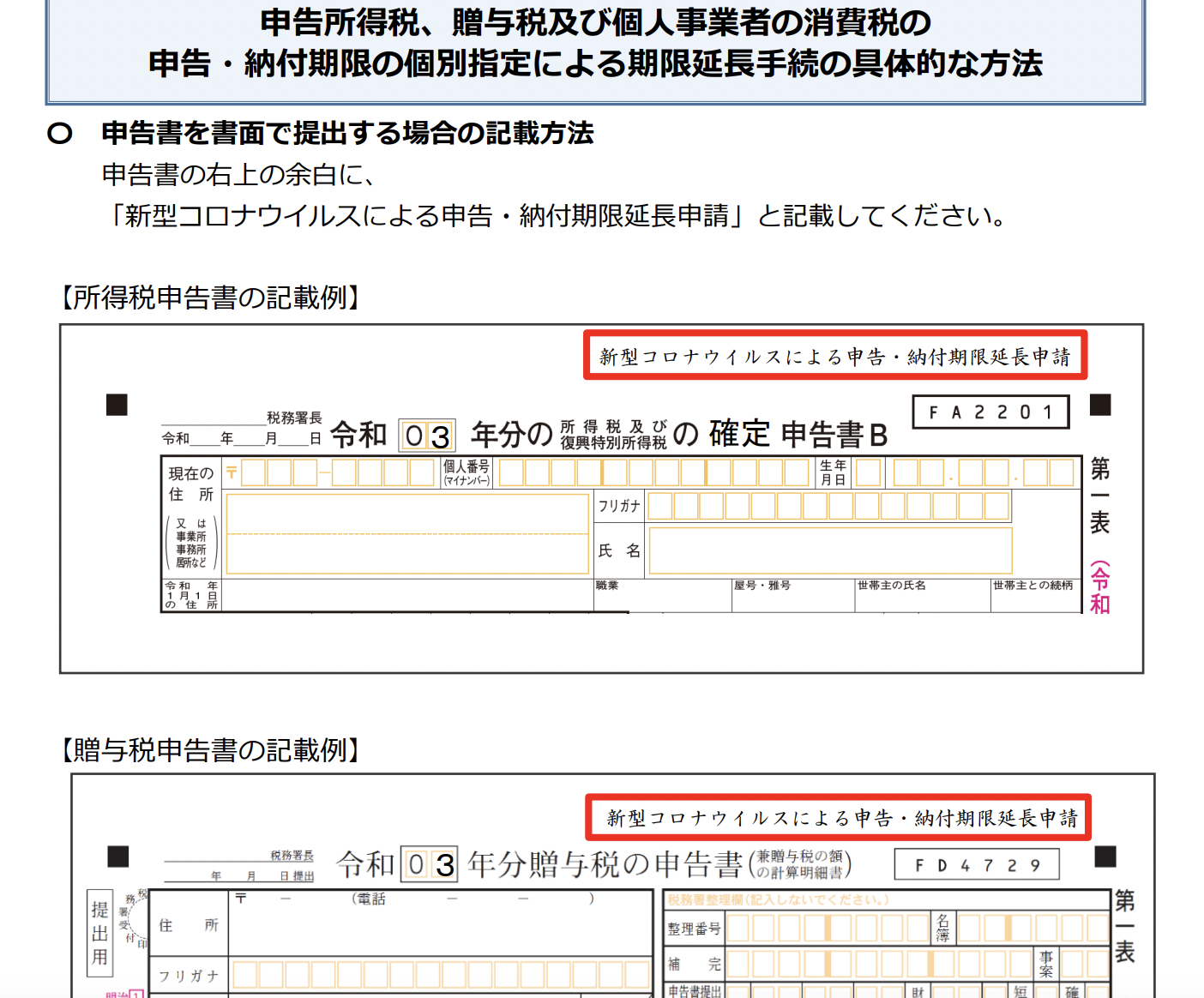

If you are affected by COVID or your accountant, you will be allowed automatically the extended deadline by April 15. You simply need to put “新型コロナウイルスによる申告・納付期限延長申請” (Applying an extension of the deadline because of COVID).

That goes the same for Inheritance tax and Gift Tax.

Corporate Tax returns will be allowed the extended deadline on the same condition but a form has to be submitted. The deadline will be extended to 2 months after the cause of the hazardous situation is over.

https://www.nta.go.jp/taxes/tetsuzuki/shinsei/annai/kosei/annai/pdf/2834.pdf