Appropriate valuation is necessary to avoid a future tax problem when you want to sell stock to your relatives or to a company that you own. Selling those stocks too cheap means that the buyer of the stocks will face possible issue of gift tax.

Appropriate valuation is necessary to avoid a future tax problem when you want to sell stock to your relatives or to a company that you own. Selling those stocks too cheap means that the buyer of the stocks will face possible issue of gift tax.

There are variety of Valuation methods like the net asset method, income approach such as discounted cash flow method (DCF), or market approach using price/earning ratio (PER) in the market. But your method is based on the tax law because there will be a wide range in pricing where you can choose the most preferable price for the transfer, and a tax problem is what you want to avoid.

I also need to add that there are a plenty of things that you can do to maneuver the valuation.

-Net Asset Method-

Each asset on its balance sheet is to be assessed separately. Land and building valuation can be very different from market value.

-Land-

A land plot that is owned by a company whose share is subject to valuation is assessed by the valuations by the National Tax Agency to price by “(road price) “.

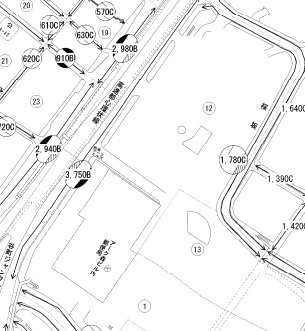

The price is presented like “2,940B” in a circce. The number represents the value in thousand yen by one square meter. The alphabet represents percentage of tenant right on land. “A” means 90%, “B” means 80%, and so on, as you can see in the map.

If the land is empty and there is no building on it, the land is assessed 100% of the road price. (It may be interesting for some that a land is more expensive for tax purposes if it does not have any building on it that generates income). If a plot has a building on it, which has tenants, it is assessed by subtracting the value of tenant right from the road price. The percentage of tenant right is “B”, which is 80%, in the example in the map in Minato-ku Tokyo, the unit price of the land with building on it is 20% of the road price.

-Building-

Local tax office has its valuation for asset tax. They send tax bills every year. Valuation of the building/house is mentioned on the bill. If it is rented out, 30% is subtracted from the valuation.