You might have heard of the term, Tokumei Kumiai (TK) before if you are in investing industry for some time already. What is it? Is it a good investment vehicle to create one for me?

Overview

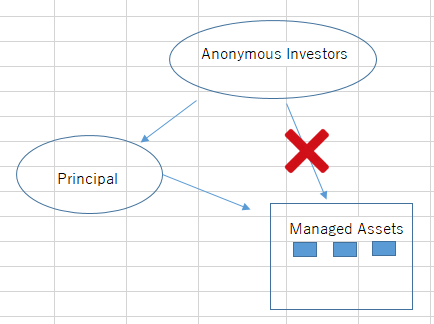

TK is not a kind of standard partnership that you would imagine where people have equal voting right based on the invested amount by each of them. It has Principal and Anonymous Investors whose roles are clearly segregated each other.

Principal is a person (either natural person or a company) who accepts investment from investors and manage. She decides the investment strategy like what to buy and what to sell. The ownership of the assets purchased by investment belong to her name.

Anonymous investors will provide capital to Principal. They do NOT have direct control over the assets nor have authority to determine the investment strategy of Principal. They give up their ownership of the investments like when you invest your money on shares of a newly established company. Anonymous investors are not necessarily silent and provide their investment opinions to Principal but they do not have right to touch their assets. They merely receive dividends when the TK makes profit.

TK is merely a private agreement between the two sides, the ownership of the asset belongs to Principal. Therefore, in case Principal falls into insolvency, creditors of Principal can come to the asset of TK. Its assets are not as segregated as you would think like Trust.

Tax

Dividends paid by TK is to be considered as deductible expense for Principal. Therefore, there is no income tax in TK, technically speaking. Principal pays tax on her profit from TK after deducting all the TK dividends as expense.

TK Investors pay income tax in form of withholding tax. Because it is regarded as similar to dividends from shares of a company, the tax rate is flat 20.42%. Because this is not dividends from shares, tax treaties between Japan and other countries are not applicable unless there is special articles.

But from an investor’s point of view, the tax rate of 20.42% is much cheaper than corporate tax, which can reach to 40%. Approximately.

Risks

Because investors do not have direct authority to control their assets, you would think you may want to create a company to become Principal for yourself.

That is a typical risk. By definition, Principal of TK and anonymous investors are separate parties. If the tax authority thinks that Principal comes from the same interest group as Anonymous Investors, they will probably deny its TK scheme and put corporate tax on TK income “before” deducting its dividends, Just as on a normal company. Dividends will not be considered as deductible TK dividends but it will only be normal dividends from a company.