最初に出てくる言葉が、「ぐだぐだ言ってないでコード書けよ、ハゲ」。著者の和田裕介さんが肝に銘じている言葉なのですが、原文は「Shut the fuck up and write some code」です。 ようはWebサービスやソフトについて、ぐだぐだ批判したり、アイディアだけが良い事だけ自慢してもあまり意味が無いのです。実際に手を動かしてコードを書きましょう、という事です。 この本は2012年の本で、出たばかりの時に本屋のプログラミンのコーナーで見つけて、すぐに買った読みました。その時も読んで非常に良かったのですが、今読んでもなかなか面白いです。ウェブサービスを作るために必要な術を身につける方法や、面白いウェブサービスを作るためのアイディアの出しかた、企画設計する方法など色々と書いてあります。技術だけでなく、面白いWebサービスをリリースして運用するまでの過程全般について書いてます。 例えば何か面白そうなアイディアを思いついたとします。アイディアは口で言ってるだけでは、どんなものか目にも見えないし他人にはよくわかりません。自分では、それがどんなに良いアイディアだと思っても、形にして世の中でどう評価されるかを見てみないと、実際に良いアイディアだったのかどうか、世の中に便利に使ってもらえるアイディアなのかよくわかりません。 著者はPerlのコードで「いかに大量のおっぱいの画像をダウンロードする」スクリプトを書いたそうなのですが、こういうアイディアを思いついたときに、自分の手を動かしてコードを書いて、実現できてしまうという事が、プログラミングってすごいなと思いました。ちなみに、このコードで一度に30,000枚ダウンロードができたそうです。プログラミングの力ってすごいです。。 ソフトウェアは、実際に作られて世に出て、人に使ってもらって初めて評価してもらう事が出来ます。もしかしたら、多くの人に便利と思ってもらえるかも知れません。場合によっては、世界の人に使ってもらえるかも知れないのです。 そんな魔法のようなことを、Mabook Airの一つもあれば、書くことが出来ます。何か不思議でわくわくする気持ちがします。 私も色々書いてます。最近作ったSkyledgerもレシートを写真でとって会計事務所に送れたら便利だなというアイディアから始まりました。 このプログラムは、iPhoneの側ではSwiftと言うAppleの新しい言語で書いています。今までのiPhoneのプログラミングはObject-Cと言う、私にとってはちょっと扱いにくかった言語が必要だったのですが、2年くらい前にSwiftが発表になりました。そこで早速飛びついてこの言語をやってみたのですが、私にとっては、最近っぽい言語であるにもかかわらず、オブジェクト指向で型が厳密なので、エラーが出にくく、プログラミンを楽しくやれる言語でした。新しい言語を使ってみるというのは、とても楽しい体験になりますね。 このサービスの普及具合は全然まだまだなのですが、この本を読んで、もっと色々作りたいなあと思いました。

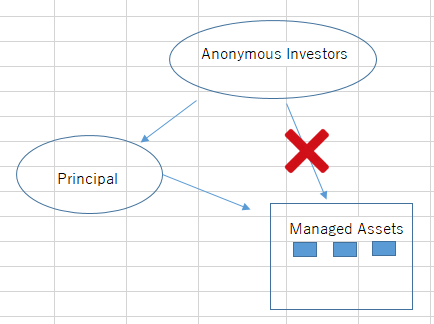

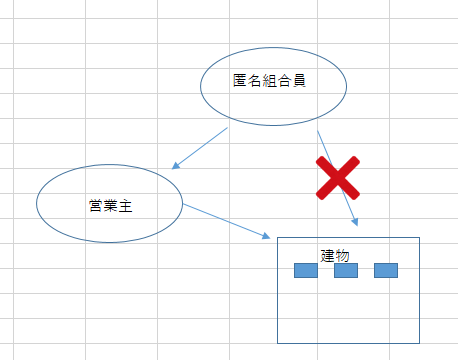

You might have heard of the term, Tokumei Kumiai (TK) before if you are in investing industry for some time already. What is it? Is it a good investment vehicle to create one for me? Overview TK is not a kind of standard partnership that you would imagine where people have equal voting right based … Read More “Tokumei Kumiai (TK) what is the point?” »

匿名組合にすると税金が安くなると不動産投資をする外国人の方たちの間で思っている方が多いようです。本当にそうなのかなと考えてみました。 ちなみに、匿名組合の分配金を非居住者に支払う時には、20パーセントの源泉所得税がかかります。それと比較して、法人税の方は、実効税率は地方税まで入れて、所得(利益)が800万までは約25パーセントです。800万円を超えると40パーセントくらいになります。 匿名組合のスキームは、商法の535条以下に規定されていますが、営業者と匿名組合員(出資者)が必要です。営業者が出資を募って、匿名組合員から出資を受けます。営業者は匿名組合員から出資を受けて、不動産などの事業に投資をして、利益が出たら分配します。 ここで注意が必要なのは、買った不動産は営業者に帰属するという事です。匿名組合員は、営業主を監視することは出来ますが、匿名組合の持つ財産を直接コントロールすることは出来ません。 また、あえて既に所有している不動産を営業主に移転すると、登録免許税や不動産取得税がかかります。これが結構高いです。 ビジネス上のリスク 匿名組合で税金が安くなるのには理由があります。匿名組合では、営業者が不動産の所有権を取得するので、匿名組合員は持っている不動産を使って匿名組合を組成するには、名義を営業者に移さなくてはならなくなります。所有権が無くなってしまうので、不動産を直接コントロールすることができなくなります。つまり、営業者が勝手に不動産を第三者に売ってしまうと、匿名組合員は不動産を取り戻せなくなってしまいます。 つまり、匿名組合員は、出資者であって営業主体ではないから、配当と同じような源泉所得税で課税関係が終わるという形になっているのだと思います。 税務で否認されるリスク そこでよくある発想は、自分で営業主の会社を作ってしまおうと言うものです。日本に小さな合同会社を作ってそれを営業主にして、そこに出資をすることを通して不動産を買おうと言うものです。 しかし、営業主と匿名組合員はお互いに無関係の別人であることが前提になっています。匿名組合員が営業主である会社を作るという事は、匿名組合員が営業者である会社の株主になっていて、匿名組合員が営業者をコントロールしてという事になると思います。 この場合、日本にある営業主であるところの会社が、匿名組合員と一体になってしまいますから、不動産を持っているのは、匿名組合員であるという事を税務当局に認定されてしまい、匿名組合員が法人なら日本における法人税、個人なら所得税がかけられてしまうリスクが相当に高いと思います。 また、営業者の会社の株は誰か第三者に持ってもらっていても、実際の投資の意思決定は、匿名組合員がやっている場合がそれなりにあると思います。例えば取締役が、匿名組合員の関係者であったりとか、意思決定が匿名組合員によってされていることがメールなどで明らかな場合は、やはり否認されると思います。 原則 匿名組合で否認されないようにすることは、原則に戻ることだと思います。つまり、出資者とは別のアセットマネージャーが不動産などを購入するファンドを組成して、そこから出資者を募ると言うものです。順番が、まず出資者がいて、営業者を何とかするのではなくて、営業者がまずいて、その会社が出資者を募るのです。 English version of explanation is available here. (私記) 昨日は子供小学校の関係の催しもので、土曜日の半日を小学校で過ごしました。竹で紙鉄砲や起き上がりこぼしなどを作って子供たちに教えるお手伝いをしたのですが、なかなか楽しかったです。 最近、再びJavaをよくさわっているのですが、Tomcatなどでエラーが出るとどこが悪いのか原因を探すのに苦労します。まだまだ、いじっている時間が不足しているのでしょう。

平成27年に法律が変わって、非居住者だけでも会社が設立出来る様になりました。 しかし、実際問題として、会社の設立には資本金の振込が必要なのですが、その振り込みをするための銀行口座開設がネックになる事が多いと思います。 にわとりと卵の関係のようなのですが、会社を作るためには、資本金の払い込みを証明するための銀行口座が既にあることが必要です。日本の法律では会社を設立する場合に、資本金の払い込みを、既存の銀行口座に振込みをして、通帳のそのページのコピーを使って証明するので、既に銀行口座がないと資本金の払い込みを証明する書類が作れないのです。 ですが、非居住者からすると、日本に銀行口座があるという事は、以前に日本に住んでいて銀行口座が残っていたなどの珍しい場合でない限り、通常は難しいと思います。また、建前論としては、居住者が非居住者になる場合には、銀行口座を閉じてくださいと言われることが多いと思います。 外国人ももちろん日本で銀行口座を開けることが出来ますが、在留カードが必要なようですので、居住者であることが前提です。 今まで日本に住んでいたことが無い本当の「ぴかぴかの」非居住者にとっては、ほとんど不可能なように思います。ネットで調べると可能っぽい事も書いてありますが、実際にやるのは相当大変なように思います。にわとりが先か卵が先かの状況のなかで、八方ふさがりの状況になってしまうのです。 そこで、代替的な案ではありますが、だれか日本にパートナーを見つけて、その方にも社員になってもらう(合同会社の社員になるには、ほんのわずかでも持ち分を持ってもらう必要があります)のが良いのではないでしょうか。日本で会社を作るのであるという事は、日本でビジネスをしようという事だと思いますので、ビジネスのどこかの時点で居住者の存在が必要になってくるとは思います。 合同会社の場合は、株式会社における株主であるところの社員は必ず持ち分を持つ必要があるので、日本の居住者が代表社員になりつつ、持ち分を持たないという事は不可能なのです。 まあ、あまり本意な解決策ではないのかも知れませんが、「合同会社の場合」、現実的なところとしてはこのくらいが落としどころなのかなとは思います。 株式会社の場合 株式会社の場合は、もっと簡単に100パーセント非居住者が株主の会社を作ることが出来ます。 設立の手続きとしては、やはり発起設立です。募集設立は、銀行もあまり経験が無いようで手続きに明るくないため、大変です。 発起設立では、株式を引き受けるのは発起人のみです。発起人には、居住者の場合は印鑑証明、非居住者の場合はサイン証明が必要です。 まずは、手伝ってもらえる居住者に1株でも持ってもらって、発起人になってもらいます。そして、この方の口座に資本金を振り込んで、資本金の払い込みの証明をすればよいのです。 株式会社ですから、取締役になるためには株主であることを必要条件ではありません。会社の設立後に、居住者である株主から、株を非居住者に譲渡すれば、非居住者が100パーセントの持ち分を持った会社の出来上がりです。 その後の重要な手続き – 消費税 会社の設立をしたら、消費税の課税事業者にするのか免税にするのかの選択が重要です。資本金が1000万円未満の場合は、選択ができます。1000万円未満のばあい、何もしないと免税になります。不動産投資のための会社を作る場合は、課税事業者になることを期末までに「選択」しないと消費税が返ってこないので、十分に気を付ける必要があります。

帳簿をきれいにするとビジネスが上手く行くし、自分も幸せになるというのが、私が10年以上税理士業をやって来た上での経験論であり、持論です。では、帳簿をきれいにするにはどうしたらいいか?また、そもそも、帳簿がきれいというのはどういう状態をいうのか? あんまり、ハイレベルな事をいきなりやっても疲れて挫折するだけなので、できることから始めるのがいいと思います。 (1)チェックリストを作る まずは、エクセルでチェックリストを作りましょう。チェックリストは、最初は2-3項目のすごく簡単なものでもいいです。まず、チェックリストを作って毎月の締めで、何をチェックしたのかを記録するようにすると、だんだん、チェックリストが充実してくるので、モチベーションも保てます。月次の締めが終わった日付が入るようにするといいと思います。 (2)銀行残高を合わせる・借入金の残高を合わせる まずは、簡単なことですが、通帳を記帳するか、インターネットバンキングをやっている場合は、残高がわかるところを打ち出して、残高を合わせます。チェックリストには、チェックを忘れないようにしましょう! (3)BS科目の残高にはすべて補助勘定を設けて、残高を全部どれかの補助勘定に割り当てる。 BSの残高は残って繰り越されていくものですから、それが何であるか一目でわかるように補助科目をつくって、残高をそれぞれに振り分けましょう。ここでポイントとなるのは、ちょっとわからないものを、「その他」とか「指定なし」みたいにして、あまり後回しにしないことです。 例えば、売掛金でしたら、残高はお客様ごとに把握するのがいいと思います。100件や200件くらいあっても、補助科目はすべてのお客様ごとに作るのがいいと思います。そして、残高を毎月確認すること。よくあるのは、お客様からの振込の際に銀行の振込手数料が864円引かれているのに、入金した金額しか残高から引かないことです。そうすると、翌月に売上が立った時に、補助残高の内容が、その売上プラス864円になってしまうので、金額が不正確になってしまうのです。これが何か月も続くと塵も積もればで帳簿が汚くなっていきます。相手を銀行手数料にしてきちんと落としましょう。 補助勘定が多すぎて一個一個作るのが合理的でない場合は、表を作って、かならず表の合計金額と勘定の残高を合わせるようにするのも、一つの方法です。 (4)源泉所得税と社会保険料の預り金はきちんと合わせる ここは、給料に関係する部分なので、計算があまり適当だと従業員の皆様からの信用に響きます。源泉所得税は、7月10日と1月20日の源泉所得税の納付の時点で一度0円になっている様にしましょう。何かの理由で0円になっていない場合は、相手が社員の給与の支払額である場合は過誤徴収、相手が納付先である税務署の場合は過誤納付と理由を分けて補助勘定を作り、残高をそこに移しましょう。 社会保険料は住民税も同じです。社会保険料の預り金は、社会保険料が引き落とされる月末に0円になるように、住民税は納付時点の翌月10日には残高が0円であることを確認しましょう。 この3つも大事なので、チェックリストに追加をお願いします。 毎月の決まった経費項目(売上も) 毎月の給与は人別で、経費も毎月ある家賃や電話代、水道代、インターネットなど補助科目を作りましょう。毎月の締めのさいに、横で比較すれば何が計上漏れになっているか、一発でわかります。 誰か第三者にチェックしてもらう事 このような項目をチェックリストにしてちょっとずつ増やしていくと、チェックリストが充実してきます。が、これをいつまでも一人(例えば経理の担当の方)だけでやると、どこかで段々めんどくさくなってきて、チェックがおざなりになってきます。ビジネスの規模がある程度になってきたら、誰かにチェックをしてもらうことが必要です。 税理士か誰かとチェックリストシェアして、一緒にチェックしてもらうと、帳簿が綺麗によみがえります。

この方の本は、実務家の視線で今の現実が書かれていて、面白いんですよ。もともと、銀行やコンサルにいらっしゃったようなのですが、その後、三井不動産で「コレド日本橋」や「虎ノ門琴平タワー」など、数多くの不動産買収、開発、証券化業務を手掛けていたようです。現在は不動産に関する仕事をご自分でやってらっしゃるようなのですが、実務家だけあって、机上の空論だけでない、実際の話が色々出てきます。 以前に「空き家問題–1000万戸の衝撃」という本を読みましたが、その時も、今日の首都圏の住宅事情の現実が色々と書いてあり、外側から不動産の広告を見ているだけではわからないことが、色々と起きていることがわかりました。 まず、本書では、バブルの時代に横浜郊外(保土ヶ谷区の方?)に一戸建てを立てた、エリートサラリーマンの方の話が出てきます。 この方は、現役の時がバブルで、当時あこがれの一戸建てに住んでいたのですが、当時1億とか1億5000万円した物件が現在は3000万円でも売れない話が出てきます。そして、こういった当時の戸建て中心の高級住宅街は、当時丘陵に建築されたことが多かったようなのですが、今そこに住んでいる住人は皆一様に高齢化してきているので、車の運転が出来なくなってくると途端に移動もなかなかままならなくなるそうです。 また、当時の平均的な家庭がこぞって買ったような、ニュータウンと呼ばれる新興住宅地の話が出てきます。いま、新興住宅地では、居住者の平均年齢があがり、少しずつと空き家が増えてきています。しかし、こういうニュータウンは都心からも遠く、駅からはバスだったりして、若い人たちはあまり入ってこないそうです。 そうして購買力の落ちたニュータウンからは、クリニックや商店が閉鎖したり、バス便が廃止になったり本数が減ったりして、段々と生活基盤が失われてきています。 こういう住宅が当時何千万、下手したら1億近い金額で取引されていたというのですから、人口増加や金融政策などの当時の状況をが今と違うことを考えても、時代は変わるという事がよくわかります。 結論 1)家は地域で買えと言うのが、筆者の結論です。が、地域の性格も10年経つと変わります。なので誰にも20年先のことはわからないと思いますが、バス便や都心まで1時間以上の不便なところはやめておいたほうが良さそうです。人口は当面減る方向というのが既定路線ですから、大きい買い物をローンで買うのは慎重なほうが良いかも知れません。 2)それとバブルには乗ってはいけない。数年間はいいのかも知れませんが、10年以上経つと世の中は変わっています。今がバブルだということは誰にも分からないとも言いますので、難しい事かも知れませんが、明らかにバブルっぽい時に、家をローンで買うのはかなり危険な行為と言えると思います。

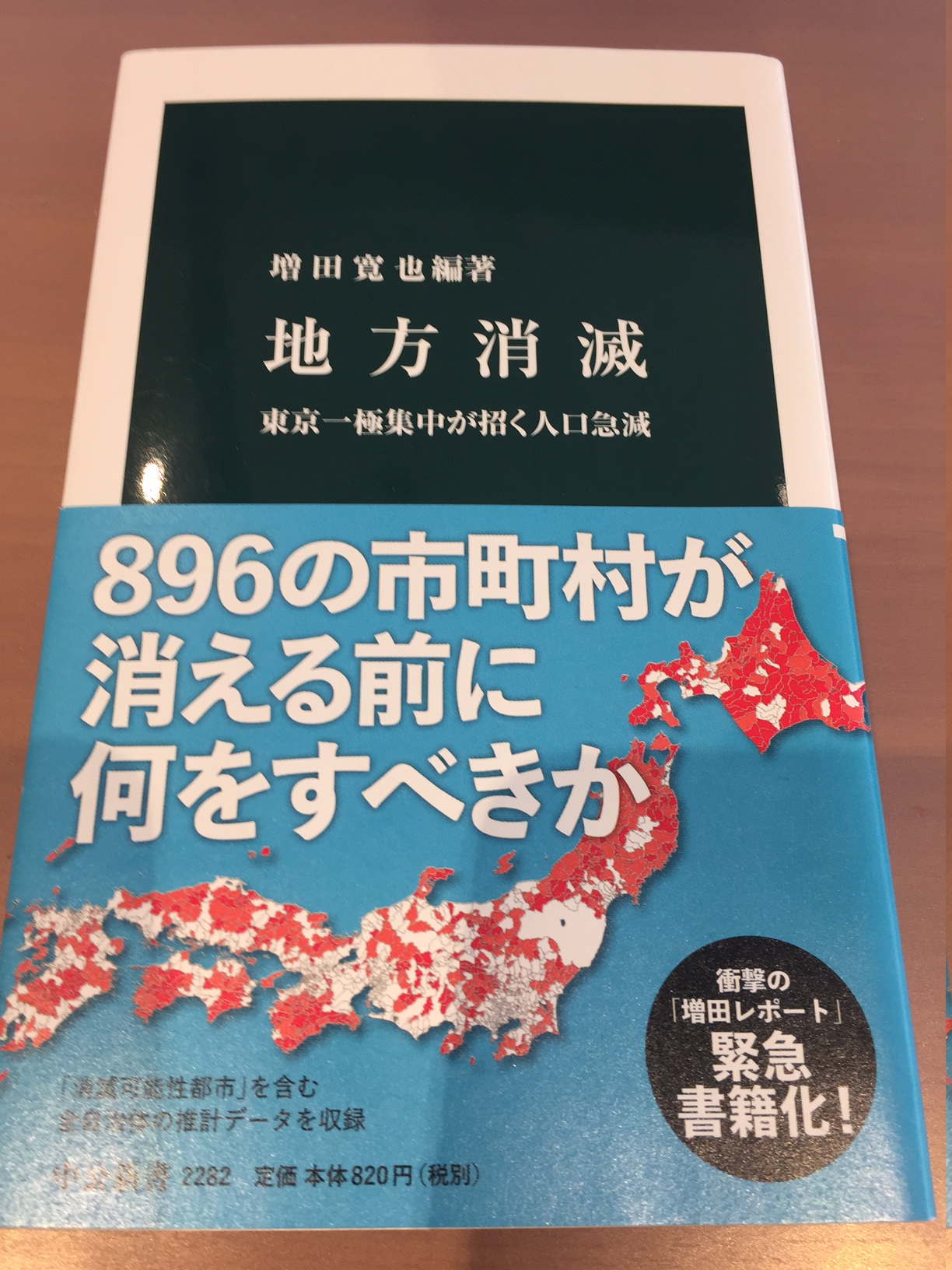

いやー、恐ろしい未来がかかれています。それも前岩手県知事で総務大臣をやっていらっしゃった増田寛也氏が、役所が作った各種のデータをもとに書いていますから、信頼度もあると思います。 「このままでは896の自治体が消滅しかねないーー。減少を続ける若年女性人口の予測から導きだされた衝撃のデータである。若者が子育て環境の悪い東京圏へ移動し続けた結果、日本は人口減少社会に突入した。多くの地方では、すでに高齢者すら減り始め、大都市では高齢者が激増してゆく。豊富なデータをもとに日本の未来図を描き出し、地方に人々がとどまり、希望どおりに子供を持てる社会へ変わるための戦略を考える」(本書より) 単純な計算ではありますが、日本の出生率が1.43とすると、人世代ごとに人口が30パーセント減って、70パーセントになっていくことを表しています。もちろん、現在の日本の人口構成では、1世代が25年くらいだとしても、3世代くらいがいますから、25年後に人口が70%になっているわけではありません。 国立社会保障・人口問題研究所の「日本の将来推計人口(平成24年1月推計)」という資料によると、2040年の総人口は2010年の12,806万人から10,728万人に、減ることが予想されています。12.2パーセント。すごい減少率です。 さらに、65歳以上のかたの人口の割合である高齢化率は、2010年の23.0パーセントから36.1パーセントに爆増することが予想されています。これは、単純に計算しても、支えるべき勤労世代が減って、支えらえる高齢者層が1.5倍に増えるということです。これって、恐ろしくないですか? 社会保障負担の増大 私も、それがどれくらいすごいことになるのか、イメージがわかないのです。単純に考えても、今の社会保険料が倍くらいになるということでしょうか?いまでも、給与所得者に対する社会保険料は、会社負担を入れても給与の30%あるんですよ。それが、皆さんの毎月の給与から控除されているのですが、これが倍近くに増えるとしたら、さすがにそこまではいかないかも知れないのですが、想像するとすごい負担です。成り立たないですよ、きっと。 この本からの学び この本を読んで何を学ぶかと言うことですが、近い将来の日本がどんな社会になりそうなのか、人口の面から予想ができます。社会保障費の増大と、それを支えるための社会保険料を含む税金負担の増大は不可避であることが想像できます。今、現役の世代の人たちは、将来の親の介護費用が相当に増加するほか、自分たちの分は自分たちでちゃんと貯めておかないと、子供に過大な負担をさせてしまうことになるかも知れません。 また、空き家もさらに増える方向になりそうです。地方では、すでに空き家が増えているそうですが、これがさらにぞうかすると思われます。 さらに、日本の国債は名目GDPが成長することを前提にして返済することになっている様ですが、これだけ人口が減っていくとなると、ちょっとやそっとの規制緩和や技術革新では難しいことがわかります。 大幅な円安を通じた相当なインフレか、預金封鎖や通貨の切替えなどの、何か非連続的な調整方法を採らないととてもではないけど無理そうなことは、直感的に感じます。 昨今では、JR北海道が相当部分の路線を廃止するために自治体と協議をしたとありましたが、このような状況は全国に増えそうです。 このような「事実」に関する本を読むと、私たちが自分の生活を自衛するためにもどのような事が必要になるのか、考えるヒントにはなると思います。 やるべき事、慎重に考えた方がいいと思われること 1)投資用の不動産の購入は、慎重にする。特に、変動金利で借りた地方の中核都市未満にある物件は、リスクが大きいように思います。地方は、人口の減少をどこで食い止めるかを真剣に議論している程で、人口は減少しています。不動産の値段が上がる要素は少ないように思います。 2) 地方への移住は慎重にする。特に、中核都市未満の限界集落的な地域は、人口がどんどん減ってます。緊急医療を提供できる病院をどこまで残すか、なんてことを議論しているので、将来、病院がなくなる、鉄道がなくなる、小学校がなくなるなんてことは、十分に起こりうるように思います。子供の教育を考えたら、小学校や中学校がなくなる事態は、あまりプラスになるようには思えません。

日経新聞などの毎日のメディアとこういう新書版の違い 普段、日経新聞なんかを読んでいても、新聞の中に載っている重要そうな記事が、この数十年単位の時間軸のなかでどう言う意味があるのかは、我々素人にはわかりにくいと思います。数年前にどういうことがあって、今回の中央銀行の発表がどんな意味があるのかは、マーケットにずっといる様な方でないと、なかなか文脈の中で判断できません。 この本は、現在のアベノミクスがどのような日本の財政の中でやられているのか、それにより日銀のバランスシートがどのような状況になっているかを、豊富なデータやグラフを使用して解説してくれています。 このような長期のコンテクストの中で、日本の財政状況の話が書いてあり、私なんか、早速今後の身の振り方を考えてしまいました。この本を読んだら皆様も真剣に今後の事を考えてしまうと思います。そういう意味でもお勧めの本です。 日銀のバランスシート 新鮮だったのが、日銀のバランスシートの話です。国債の残高が1200兆円を超えているとか、GDP比率が250%に近くなってきている話は、誰でもよく聞きますが、日銀のバランスシートの話は私は知らなかったです。 今、黒田総裁率いる日銀は、世界を仰天させた異次元緩和をやって日銀のバランスシートを膨らませています。リーマンショック後のFEDやPIIGSの国債が売られた時やギリシャ危機の時のECBも、債券や国債を買ってバランスシートを膨らませてきました。 FEDやECBではどのように量的緩和を解除して、積みあがったポジションを平常の状態に戻していくかという事が、議事録にも残してあるように真剣に議論されているようです。 こんな事を教えてくれる事が、こういう専門家の本の価値だと思います しかし、ここがこういう専門家の本を買うことの価値だなと思うのですが、著者はFEDやECBの議事録を読んで、どのように出口戦略が議論されているか、原文を調べているのです。こういう所はやはり専門家が時間を使って初めてできることで、私たちのように一般人が、自分の仕事を持っている中で自分の時間を使って調べるなんて、とても出来ない訳です。それが、消費税を入れても800円をちょっと超える値段で買えるのですから、本当にお得です。この部分だけでも800円の価値の100倍くらいは軽くあるように思います。 今後何が起こるのか ひるがえって、日銀の場合は「時期尚早」と言うことで、少なくとも表向きにはしっかりとした言葉では説明されていないそうです。 通常、こう言う量的緩和をやった場合の中央銀行のバランスシートは、GDPの50%とか何百兆円とか言う規模で資産が積みあがっているので、この資産を市場で売却して残高を解消していくと、市場の金利が上昇します。マーケットにあまり影響を与えないように、FEDなんかの場合は、債権を満期までもって、そこで新しい借り換えの債券を買わないようにするなどして、自然減で資金の回収を図ったりするそうですが、その方法や、時間軸・マーケットに与える影響などを真剣に議論して議事録に残しているそうです。通常、拡大したバランスシートの解消には10年くらいの非常に長い時間がかかります。 日銀の場合も、そのようにして積みあがったポジションを解消していく必要があります。 ここで、著者が指摘しているのですが、日銀のポジションはすでに400兆円くらいあるそうです。ポジションを解消していく中で金利が上昇していきますから、日銀には相当の評価損が出ることが予想できると書いていいます。この評価損が問題で、日銀の場合は債務超過になる可能性が書かれています。日銀が債務超過になった場合に、どのような影響があるのかは私にはよくわかりませんが、金融市場に与える影響が甚大になる可能性はあると思います。 国家が債務を返済できなくなった場合に何が起こるか これについても、ギリシャで起こった緊縮財政や年金の支給年齢が繰り上がったこと、戦後の日本で起きた新円切替や預金封鎖の話が書いてあります。 近い将来に、相当に高い確率で起きる未来に対して、私も自分はどうしたらいいのかと考えてしまいました。きっとこれを読んだ方も皆様も、これから高い確率で来るかも知れない大津波に対して、一体どのようにして自分の生活を防衛したら良いのだろうと考えてしまうと思います。そういう役に立つ情報や刺激も含めて、読書の価値だなと思います。 私が考えたやるべきこと 1)円の現金を減らして、何か違うものに替えておくこと。当局がインフレを通して債務を減らしたいと考えているかどうかは私にはわかりませんが、日銀のバランスシートが将来傷むのは間違いありません。円の名目価値が下がらないと政府の債務は現実的には返せそうに無いですし、そうではない場合には、暴力的な方法で債務を帳消しにするしか方法はなさそうに思います。いずれの経路をたどるにせよ、円をせめて、ドルかユーロなどの違う通貨建ての資産にしておくのは、少しは自己防衛になるのではないかと思います。 2)値下がりのリスクはもちろんありますが、金や原油などの世界で流通する価値のある現物資産を持つのもリスク分散の観点からはいいと思います。これからドルの金利が上がると、金などの現物資産の価格は下がるかも知れませんが、持っている資産のうち少しの割合ならいいのではと思います。どうせ、日本円の価値は下がらざるを得ないのですから。 3)変動金利で借金をして、不動産を買うことは慎重にした方がいいと思います。日銀が国債を買い続けることによって、金利は低いままで抑制されるかもしれませんが、そうであるなら、円の価値が外貨に比べて下落すると思います。円を防衛するためには、日銀は金利を上げなくてはいけなくなりますが、その場合には、政府が借り入れを返せなくなるのと同じように、変動金利で借金をしてしまった、私たちも死んでしまいます。金利があがれば、資産の価値は下落するし、毎月の返済も上昇するからです。 また、あたるかどうかはわかりませんので、適当に聞き流していただけると幸甚です。

税理士である自分にお客様は何を求めてお金を払っているのかを考えて、自分でわからなくなることがあります。 税金を安くして欲しいと言う要求も常にあります。 特に去年(H27)や今年(H28)は株高があったこともあり、明暗はありますが、比較的利益の出た会社も多かったです。でも、99%のお客様は「合法」の範囲内で出来る事をやって欲しいとおっしゃいます。つまり、脱税をしてまで税金を安くしたいという人は、ほとんど居ません。「何とかなんないんですか?」と食い下がる方(暗にほのめかす方)もいらっしゃいます。でも、税金の世界にも出来る事と出来ない事があるので、出来ない要求には応えることができません。そういうお客様は私の事務所には現在いないと思います。 では、そう言うブラックな要求に多少なりとも応えないと、仕事がなくなり、食べていけなくなるかと言うと、意外とそうでもないのです。私の事務所でも、10人くらいの人数を抱えて、これまで10年以上やって来れてます。資格の必要な商売ではありますが、寡占のない自由競争の業界ですし、お客様は、嫌ならいつでも他の税理士の所に行くことが出来ます。それでも、自分のお金を払って使っていただけるのは、何らか価値が提供できているからなのだと思います。 税務会計の知識は、絶対に必要でしょう。 税務や会計のルールは毎年変化するので、フォローするのは大変です。 でも、ついて行かないと税額控除や特別償却などの恩恵を見逃してしまいます。 最近、失敗してしまったのは、課税売上割合が95パーセントを下回ったときに、一括比例配分方式で、課税売上割合以外の方法が使えたのに、使わなかったことです。この方法を使うには、会計期間の終了時点(3月31日)までに届け出を出していなくてはいけなかったのですが、課税売上割合が95パーセントを下回ったことに気が付かなかったのと、届出を出せばもっといい方法があったということに気が付いていなかったのです。課税売上割合以外の割合を使えるということは、知識では知っていたのですが、それを実務で生かすことができませんでした。 こういうミスを防止するには、私の思いつく範囲では、チェックリストしかないように思えます。多くの決算対策は期末の時点で現金が動いていることが必要だし、届出は決算の前に出して無くてはいけないのも多いですから、やはり、決算の2か月前には、一度お会いして状況を確認するという事が必要なのでしょう。 なんらかの専門性 税務会計以外に何か強い分野があるといいです。私の事務所は英語でのコミュニケーションは得意ですが、それ以外は法人税にしても消費税にしても、常識的な範囲にとどまっています。外科における心臓外科手術のような何か突き抜けた得意分野があるといいなと思うのですが、今のところ、お客様の色々な要求にこたえるように努力しつつやって来た結果、小さな総合商店のようになってしまっています。 値段 値段は、提供する側からすれば高い方がいいに決まっているのでしょうが、サービスを買う側からすれば安い方がいいに決まっています。安すぎると、サービスを提供する側が疲弊するので、避けるべきでしょう。高すぎるのは、世の中にはマーケットがあるのですから、長くは続きません。すべてのお客様と付き合おう、どんなお客様にも好かれようとしないのがポイントのように思います。 だんだん寒くなってきましたが、冬は空がきれいです。

天皇陛下の心臓手術をした心臓外科医の天野先生のこれまでの半生を書いた本です。 いくつかの重要な意思決定の話が出てきますが、この先生がこだわっていたのは、シンプルに手術の数だそうです。年間に何百回という数をこなすと言うことを具体的に自分の中で決めていたとおっしゃっています。外科医が手術が上手になるには、場数が大事だとおっしゃっています。 医者でも転職することはありますが、やはり転職して思ったように行かないこともあったようでした。民間の病院からある横浜市の大学病院に転職した時に、この転職先では周辺住民の平均年齢が若いこともあり、手術数がすごく落ちたのだそうです。転職して思ったのと違うと行って見てから気づくのは、医者も他の仕事も同じなのですね。当たり前なのでしょうが、新鮮でした。 そこで、手術が多く行える順天堂大学病院にもう一度転職したのだそうです。 人から求められるものを一生懸命やるというのが、職業の基本だと思うのですが、やはりそれだけではなく、自分はどういう方向に進んでいきたいのかというものを常に持っているというのも大事だと言うことだと思います。 お客さん(雇い主)はよく見ています。特に、お金を出して人を使う場合には、その人がその仕事がちゃんと出来るか、ちゃんとやってくれるかをシビアに見ていると思います。 なので、自分では得意だと思っていることでは認めてもらえずに、お金を払ってもらえる仕事と、自分がやりたい仕事が違ってしまうという事はよくあります。自分の事はどうしても甘く見てしまうので、逆に客観的に見れていません。他人の方が自分の事を客観的に見ているというのは、結構、岡目八目という通りで真実なのでしょう。 それで、よく自分が好きな事をやるより、自分が得意なこと(しかも自分がそう思っているわけではなくて、他人がそう評価していること)をやるべきだという事が、よく言われます。 きっとそうなのでしょうが、10年単位の長期間の関心を持ち続けて、技を磨いていくためには、やはり他人の視線だけではなくて、「自分はこの方向に進みたい」という自分の意思を持ち続けることも重要なのだと私は思います。 それに、「天才!」などの本にもありますが、10,000時間の法則などと言うのもあります。10,000時間続ければ、最初は下手で人に評価されなくても、誰でもすごいレベルに到達できるのです。