The tax law about director salary is simple, although it may look otherwise.

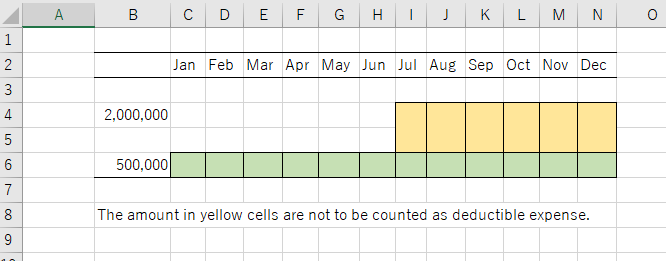

The law says that only fixed amount of director salary is deductible from taxable corporate income. It does not mean that you cannot change/raise your salary during a fiscal year but it only means that the raised salary will not count as deductible expense for the tax calculation.

If you are trying to raise your salary from July and if your fiscal year is from Jan. to Dec., your salary from July to December will not be counted as deductible expense for the tax purposes. For example:

Sales: 20,000,000

Your salary: 9,000,000 (1,500,000 * 6 months)

Other expense: 8,000,000

The net income will be 3,000,000 yen (20M – 9M -8M) but the taxable income will be 12M (20M – 8M).